city of montgomery al sales tax application

We recommend that you obtain a Business License Compliance Package BLCP. Find due date information for monthly quarterly and annual filings of taxes administered by Sales Use.

Property Tax Alabama Department Of Revenue

Box 4779 Montgomery AL 36103-4779 Tax Period and complete lower portion of back side TOTAL AMOUNT ENCLOSED.

. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions. Taxpayer Bill of Rights. 3rd Floor Montgomery AL 36104 Phone.

This tax is in lieu of the 5 general sales tax and is effective through december 31 2020. SalesSellers UseConsumers Use Tax Form. What is the sales tax rate in Montgomery Alabama.

Box 830469 Birmingham AL 35283-0469 ACCOUNT NO. The Alabama sales tax rate is currently. Sales and Use Tax Division PO.

900 AM - 400 PM. The minimum combined 2022 sales tax rate for Montgomery County Alabama is. This is the total of state county and city sales tax rates.

It will contain every up-to-date form application schedule and document you need in the city of. 2022 the City will be transitioning to a new payment mailing address for business license and tax payments. 2018 pj sales tax updated oct.

Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions. Permitsmontgomeryalgov 25 Washington Ave. Use tax is the counterpart of sales tax and should be paid by individual or businesses when making purchases outside the City of.

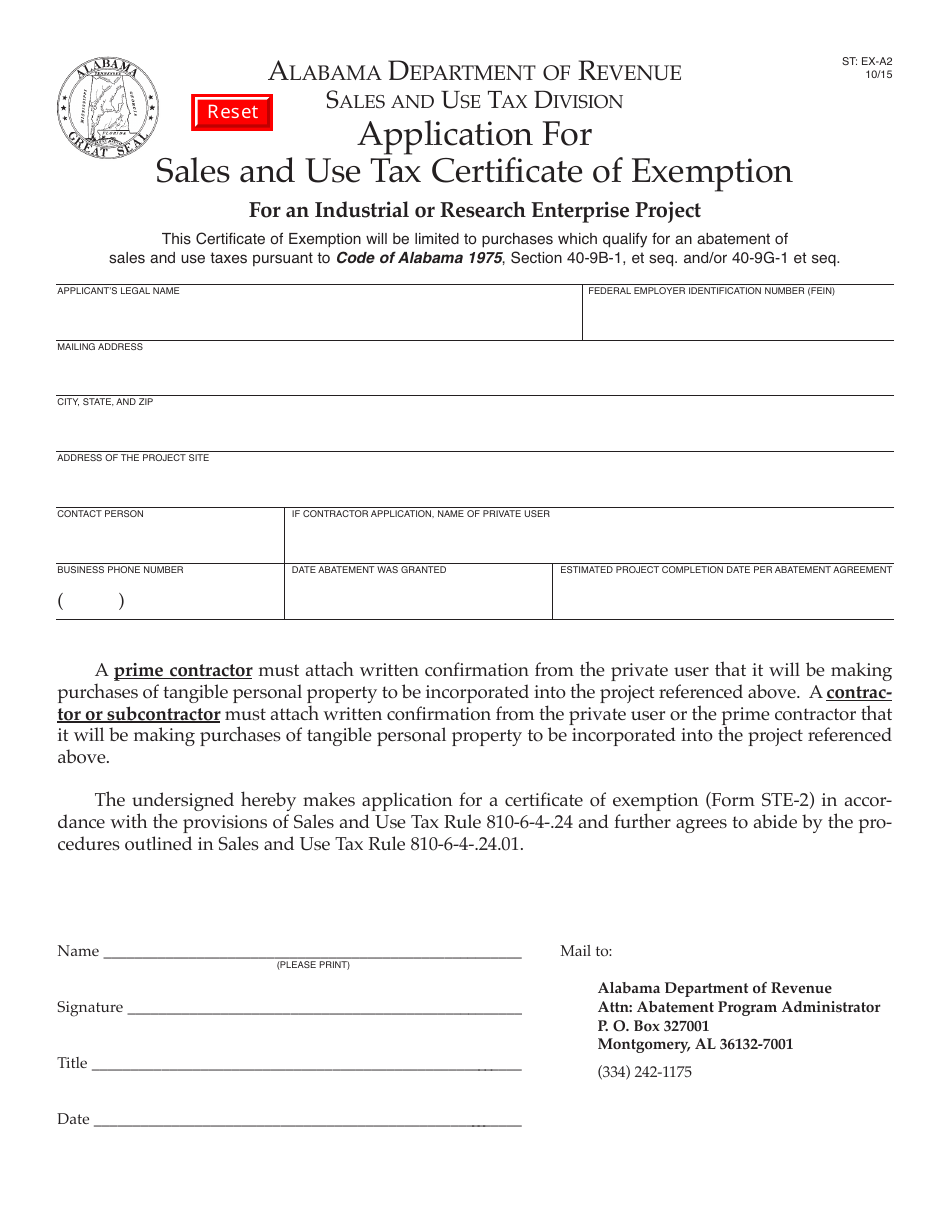

Application for Sales Tax Certificate of Exemption ST. To avoid the application of penalty andor interest amounts this reports must be filed on or before the 20th of the month. Heres how Montgomery Countys maximum sales tax rate of 10 compares to other.

Montgomery County Commission Tax Audit Department P. Montgomery AL Application For SalesUse Tax Registration. EX-A1 520 v c.

To report a criminal tax violation please call 251 344. What is the sales tax rate in Montgomery Alabama. In all likelihood the Application For SalesUse Tax Registration is not the only document you should review as you seek business license compliance in Montgomery AL.

SALES TAX ALCOH. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. SalesUse Tax - General Rate Unabated Education Tax.

Box 5070 Montgomery AL 36101. Instructions for Uploading a File. Did South Dakota v.

Use tax is the counterpart of sales tax and should be paid by individual or businesses when making purchases outside the City of. Columbiana additional 4 sales tax on the retail sale of any liquor or alcoholic beverages excepting beer sold for on or off premises consumption. You can find more tax rates and allowances for Montgomery County.

If you need information for tax rates or returns prior to 712003 please contact our office. If paying via EFT the EFT payment information must be transmitted by 400 pm. Tax due no later than the 20th.

CITY OF MONTGOMERY ALABAMA Revised 082018 Sales Tax Sellers UseConsumers Use Tax. City of montgomery al sales tax application Saturday April 16 2022 Edit. To avoid the application of penalty andor interest amounts this reports must be filed on or before the 20th of the month.

SalesSellers UseConsumers Use Tax Form. Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO. Box 327740 Montgomery AL 36132-7740 Taxpayer Service Centers.

Montgomery Countys Vendor Registration Form and Commodity ClassSubclass Code Director are provided below. The minimum combined 2022 sales tax rate for Montgomery Alabama is. 2019 Sales Tax updated Oct.

This is the total of state county and city sales tax rates. To avoid the application of penalty andor. Montgomery AL 36103-5070 334 625-2036.

City of Montgomery Lodging Tax updated Dec. 334-625-2994 Hours 730 am. Prepare and file your sales tax with ease with a solution built just for you.

Alexander city auburn and montgomery al chevrolet shoppers can simply fill out our secure online credit application to get the ball rolling. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail. Central Standard Time on or before the due date to be considered timely paid.

Access directory of city county and state tax rates for Sales Use Tax. The County sales tax rate is. Each county has a different sales tax rate and each city has a different.

CITY OF MONTGOMERY ALABAMA Revised 112018 Sales Tax Sellers UseConsumers Use Tax. City of Montgomery AL Home Menu. Motor FuelGasolineOther Fuel Tax Form.

SalesUse Tax - AutoAgManuf Unabated Education Tax. Print and fill out the vendor registration application 2 pages and mail your application to the following address. City of Montgomery AL Inspections Department.

The Montgomery sales tax rate is. The minimum combined 2022 sales tax rate for Montgomery Alabama is. Sales Tax - Vending.

2018 Gas Tax updated Dec. The Alabama sales tax rate is currently. CITY OF MONTGOMERY ALABAMA Revised 112018 Sales Tax Sellers UseConsumers Use Tax.

Childersburg tax rates for rentals made and lodgings provided within the corporate limits and police jurisdiction of the city. Mothers Day at Zoo. Use tax is the counterpart of sales tax and should be paid by individual or businesses when making purchases outside the City of.

Current rate 225 per room per day or a portion of a day such room is rented or furnished to a transient for consideration within Montgomery County. To avoid the application of penalty andor interest amounts this reports must be filed on or before the 20th of the month. Free viewers are required for some of the attached documents.

Montrose AL Sales Tax Rate. Sales and Use taxes have replaced the decades old. An Alabama Sales Tax Certificate of Exemption shall be used by persons firms or corporations coming under the provi-.

2018 Rental Tax Return- City Police Jurisdiction. Businesses that are located in the city of Montgomery or conduct business inside the city limits or police jurisdiction should contact the City Business License Department for city licensing information. How to Start a Business Roadmap.

/https://s3.amazonaws.com/lmbucket0/media/business/atlanta-hwy-al-108-2PSH-1-3_G8fc1BJxK7F5IE90wviRQJ8nOCxxO-ejmyEpHttlw.10205012b026.jpg)

T Mobile Perry Hill Crossing Montgomery Al

Minnesota Sales And Use Tax Audit Guide

/https://s3.amazonaws.com/lmbucket0/media/business/montgomery-5993-1-yKPX1Vou2cmt9UiB33reJDH5E5BoZpo5uEJgNC4Zde4.11ec5931b9e1.jpg)

T Mobile Eastern Calmar Montgomery Al

County Parks And Community Centers Montgomery County Al

3462 Bankhead Ave Montgomery Al 36111 Mls 510921 Zillow

County Parks And Community Centers Montgomery County Al

Fill Free Fillable Forms State Of Alabama

Montgomery Al Land For Sale Real Estate Realtor Com

County Parks And Community Centers Montgomery County Al

Alabama Collected Record 12 2b Revenues In 2020 Alabama Newscenter

Fill Free Fillable Forms State Of Alabama

4500 Woodledge Dr Montgomery Al 36109 Mls 512752 Zillow

Emergency Rental Assistance Montgomery County Eramco Montgomery County Al

Fast Facts About Montgomery County Montgomery County Al

Form St Ex A2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller